GOP Tax Blueprint Would Raise the Cost of Capital and Reduce Investment, According to Goldman Sachs!

We often focus on the negative impacts that the House GOP Tax Blueprint, and its proposal to allow "Full Expensing," will have on home owners, seniors, the environment, real estate professionals, tax revenue, and the entire economy if we don't tell Congress to shut it down now. Today we take a look at how the elimination of business interest deductions and the introduction of full expensing could even have a negative impact on the very companies these policies are supposedly intended to help. Specifically, all things being equal, these policies would ultimately increase the cost of capital, decrease cash flow, and reduce investment, all of which would drag the economy down and reduce tax revenue.

What's more is that this analysis comes from none other than Goldman Sachs! Here are some highlights.

###

Here we tackle two ... proposals: eliminating or capping net interest deductibility and shifting to full immediate expensing of capital investment. While we do not address the impact of a reduction in the statutory corporate tax rate here, we think it is highly likely such a cut would accompany the elimination of interest deductibility.

Under the House Republican plan, the deductibility of corporate net interest expense would be repealed.

[Editor's note: Another way to put this is that the House Republicans are proposing a new tax that applies to the interest borrowers are already paying out to big banks. This makes it even more difficult to start, maintain, or grow a small business unless you are wealthy enough to fund your efforts entirely with your own capital. Currently about 2/3 of small businesses use financing. Existing businesses that rely on loans would be crippled or killed off entirely.]

In return, companies would gain the ability to immediately deduct the cost of capex from their income instead of depreciating it over time. Full expensing of capex is intended to incentivize investment spending by reducing its cost, while repealing the deductibility of net interest is intended to eliminate the preferential tax treatment of debt financing over equity financing under current law, which incentivizes firms to increase leverage...

[Editor's note: This further privileges large corporations and wealthy investors who already have plenty of their own capital to invest. Furthermore it distorts the market by privileging companies heavily reliant on equipment to be expensed over companies that aren't so equipment-heavy, and incentivizes purchasing decisions based purely on tax incentives instead of sound business and economics.]

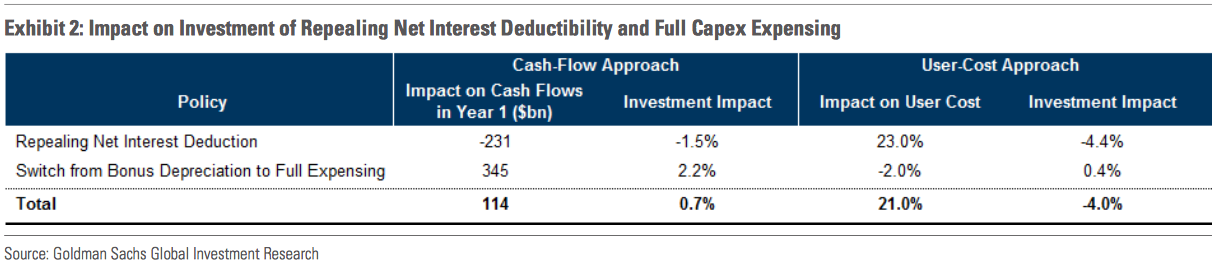

We consider the impact of these policies on investment spending both through the impact on firms’ cash flows and using a traditional “user cost of capital” model. The after-tax “user cost” is the cost to a firm of using capital for its business activities over a period of time, after taking into account not only interest and depreciation but also the tax rate and any tax incentives. The net impact of the two policies would boost firms’ cash flows over the next year because the savings from pulling forward depreciation would outweigh the loss of the interest deduction. After the first year, however, the impact on cash flow would begin to decline and eventually turn negative.

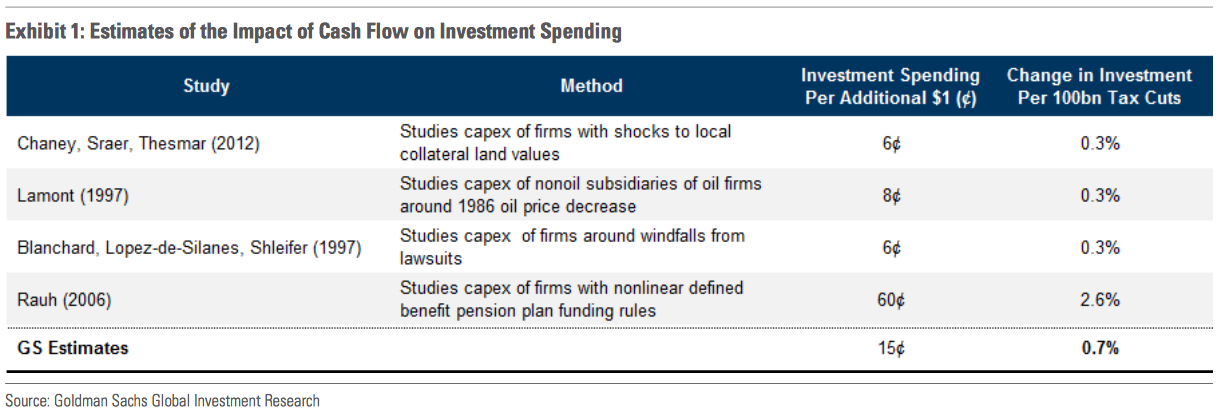

To estimate the impact of increased cash flow on near-term investment spending, we survey econometric studies. Most such studies analyze the capex response of firms that have benefited from cash windfalls that were not reflective of greater profitability, such as a favorable outcome in a lawsuit. Looking across a number of studies, summarized in Exhibit 1, we estimate that an additional $1 of cash flow raises investment spending by roughly 15 cents. This implies that $114bn worth of corporate tax cuts would boost investment by $17bn, or about 0.7% of private nonresidential investment.

In the medium to longer run, the impact of these policies on investment is better gauged through the user cost model. Completely eliminating net interest deductibility in isolation would raise the after-tax user cost by about 23%.1 Using an average estimate of the impact of the user cost on the capital stock implies that this would reduce investment spending by a bit over 4% per year if the adjustment were to occur over a five-year period, as shown in Exhibit 2.2 Full expensing would cut the other way, lowering the user cost of new investment somewhat. The reason is that although companies are eventually able to expense the full value of investment under existing law, the net present value of the depreciation allowance would rise under a shift to full immediate expensing.

Using these two approaches, we can estimate the net impact of the two policies on investment spending both over the next year and in the longer run.3 As Exhibit 2 shows, our estimates imply that the two policies would roughly offset over the first year, boosting investment by less than 1%. In the longer run, the net effect of the two policies alone on investment spending via the user cost would be negative...

The proposals to repeal net interest deductibility and replace it with full expensing of capex are just two parts of the corporate tax reform package proposed by House Republicans. In combination, these two policies alone would likely provide a small boost to investment spending over the next year relative to our current projections, but would raise the user cost of capital and reduce investment in the longer run.

1We estimate the increase in the user cost from the increase in the effective corporate tax rate implied by eliminating the net interest deduction.

2Specifically, our calculation assumes that the elasticity of the capital stock with respect to the user cost is -0.1.

3We assume that the funding mix of capital spending between debt and equity remains unchanged.

###